Do grants and subsidies from a third party form part of the VAT base? The ECJ answered this question in the affirmative in the proceedings C-573/18 and C-574/18. The case concerned the financing of capital goods via an operational fund. The decision shows the means by which the tax authorities attempt to make subsidies or grants de facto subject to taxation.

1 Background

The decisions of the ECJ dated 9th October 2019 in the cases C-573/18 and C-574/18 deal with the question of to what extent a supply subsidised by a third party is subject to VAT. The Federal Fiscal Court asked the ECJ whether there was a “subsidy directly linked to the price of the transactions” which increases the VAT assessment basis.

2 Facts

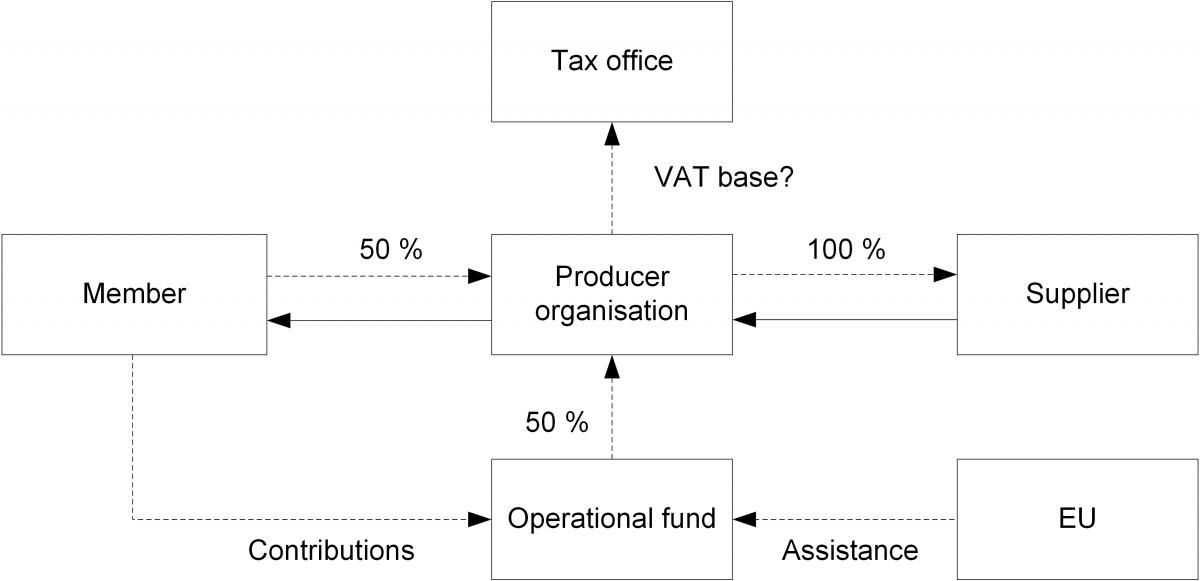

The Plaintiffs are wholesalers of fruit and vegetables and as such are classified as a “producer organisation” within the meaning of Art. 11 of Regulation No. 2200/96. They ran an operational fund to finance investments by their members. The Plaintiffs sold capital goods to their members and only charged their members a proportion of their acquisition costs plus VAT. The remaining costs were borne by the operational fund.

3 ECJ decision

In the case of supplies, which are reduced in price as a result of co-financing from an “operational fund”, the ECJ ruled that payments from the fund constituted third-party consideration. The ECJ applied the general rules from Art. 11 part A para. 1 lit. a Sixth Directive (which generally corresponds to Art. 73 of the Directive 2006/112/EC).

According to this, the VAT base is deemed to be everything that constitutes the value of the consideration received by the supplier from the recipient or a third party, including subsidies directly linked to the price of these transactions. It is in line with the objective of this provision to impose VAT on the total value of the consideration and to avoid a subsidy payment leading to lower taxation.

To be included in the VAT base, the ECJ requires that (1.) the subsidy is paid by a third party and only with respect to a specific supply, (2.) the subsidy benefits the purchaser of the object and (3.) the consideration represented by the subsidy must be identifiable.

4 Consequences for the practice

Based on the criteria of the ECJ, a demarcation between the taxable remuneration components and non-taxable subsidies is possible in constellations in which certain supplies are subsidised by third parties. On 1st January 2019, the German legislator amended sec 10 para. 1 sentence 2 of the German VAT Act in order to meet the requirements of Art. 73 of the Directive 2006/112/EC.

Since then, subsidies have, in principle, constituted part of the consideration. However, not every subsidy necessarily forms part of the compensation and thus part of the VAT base. The amount of the subsidy is only subject to VAT as consideration from third parties if the subsidy is directly linked to the price of the transactions.

The facts on which the ECJ ruling is based are a prime example of the approaches used by the tax authorities in the case of grants and subsidies. The following three approaches, are those most frequently used by the authorities in order to make subsidies or grants de facto subject to taxation:

- increase of the VAT base, either by the acceptance of consideration from a third party or by the determination of the minimum VAT base according to sec 10 para. 5 No. 1 in conjunction with para. 4 of the German VAT Act,

- deduction of input VAT, or

- classification of grants and subsidies as consideration for a supply.

In practice, these aspects are relevant if there is no right to input VAT deduction. Affected taxable persons – often public welfare institutions – are required to strictly comply with the provisions of sec.10.2 of the German VAT Circular when making subsidy payments and grants.

On the one hand, it must be ensured that there is no direct link between the supply provided and the payer’s subsidy/grant, otherwise there would be a situation where consideration is provided for the supply to the payer. On the other hand, it must be avoided that the subsidy/grant supplements the recipient’s payment and thus takes on a price filling character and consequently constitutes third-party consideration.

Subsidies granted on the basis of a mutual agreement are, from a VAT law perspective, basically an indication of an exchange of supplies of services.

The German tax authorities remain “generous” when structural or general political or economic objectives are in the foreground. These must be worked out. In practice, the facts are decisive. In cases of doubt, it is recommended to obtain a binding ruling.